The term “commodity super cycle” is something I’ve been hearing regularly. Most metal recyclers believe we’re in a super cycle; I wanted to know how business owners can navigate this type of cycle, as well as how it plays out from peak to wind down.

I turned to my colleague, David Hunter. A 48-year financial market veteran, David’s experience includes managing global portfolios and equity pension funds, as well as market forecasting.

Tom: Are we in a commodity super cycle?

DH: First, let’s define it. A super cycle is a cycle that is unusually long in duration and very extreme in bottom to top price movement, far beyond what is seen in normal cycles. For example, I believe we are in the last decade of an economic super cycle, which I define as the period between two depressions, the last being the Great Depression of the 1930s and the next depression being one that I expect to hit in the 2030s. Within a super cycle are many shorter economic cycles with upturns and recessions.

Right now we are hearing a lot about a commodity super cycle because after decades of flatness, commodity prices are beginning to break out and show major price strength. I think it is premature to say we have entered a commodity super cycle because I expect a sharp economic downturn in the second half of 2022 to send commodity prices back down — and down sharply. All sectors of the global economy will be hit hard by this downturn, including commodities.

There will be a strong recovery beginning sometime in 2023 fueled by massive fiscal and monetary stimulus. It will be focused on infrastructure, and we’ll see similar expansion across the globe. Unlike recent recoveries, this one will not be led by the consumer. Rather, it will be an industrial-led recovery.

As a result, demand for commodities will surge and remain strong through the decade. This will drive commodity prices ever higher for several years. We will see prices of all commodities soar to levels few can imagine today. This will be the commodity super cycle.

As I like to say, thinking the commodity prices go straight from here into that super cycle is the equivalent of standing on the South Rim of the Grand Canyon and looking at the North Rim and thinking it is just a short walking distance away because one failed to account for the canyon that lies between the two rims. The same is true of commodities. There is a big canyon in the form of a global bust that lies between the current strong commodity boom and the big commodity cycle that will follow the bust.

Continue reading »

Readers of this blog know we’re advocates for regular shredder maintenance. In the July/August issue of Metals Recycling, Ken McEntee interviews several people in the industry about this very topic.

Readers of this blog know we’re advocates for regular shredder maintenance. In the July/August issue of Metals Recycling, Ken McEntee interviews several people in the industry about this very topic.

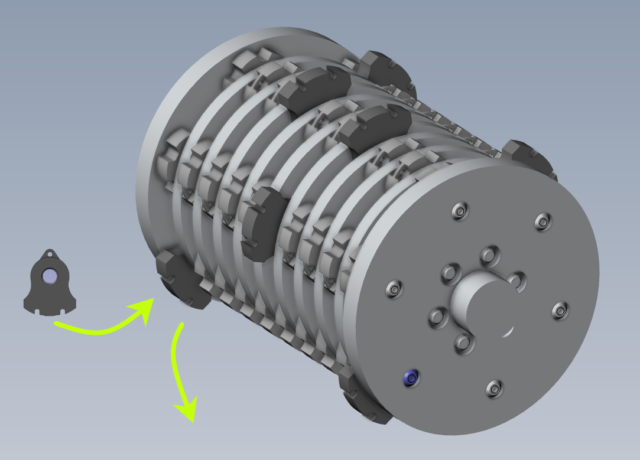

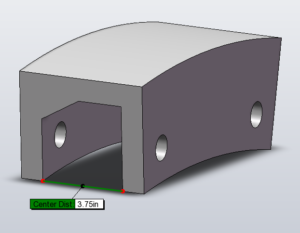

These heavy duty caps are for high output rotors. If your machine runs a beveled end disk for the extra wearing cap, you may be able use these protective wear caps. Contact K2 Castings for details.

These heavy duty caps are for high output rotors. If your machine runs a beveled end disk for the extra wearing cap, you may be able use these protective wear caps. Contact K2 Castings for details.