ISRI 2023 featured a moderated panel discussion, “Spotlight on Copper.” Panelists included John Gross, John E. Gross Consulting, and publisher of The Copper Journal; David Schilberg, Metal Buyer, Prime Materials Recovery; and Matt Bedingfield, President of Recycling, Wieland N.A. Recycling.

John Gross led the discussion with a presentation of detailed charts. The U.S. is seeing a resurgence in copper recycling – as well as secondary smelting facilities being built.

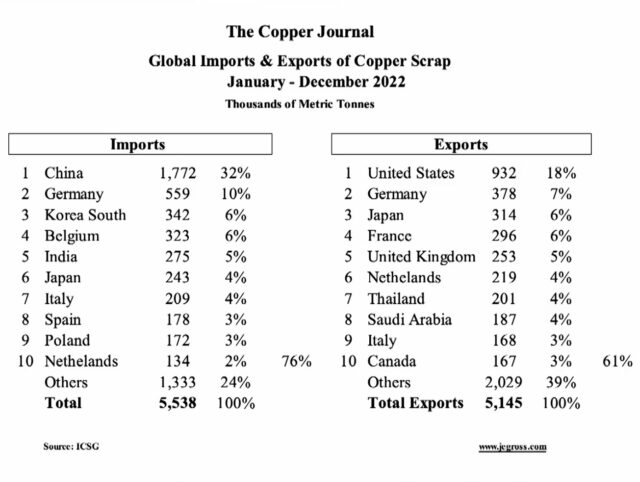

Global competition for copper will increase, with China indicating that they plan on increasing their import of the material. According to Gross’ data, China is the scrap market. China imports 32% of the world’s scrap – while the U.S. exports 18%.

Figure 1: © The Copper Journal

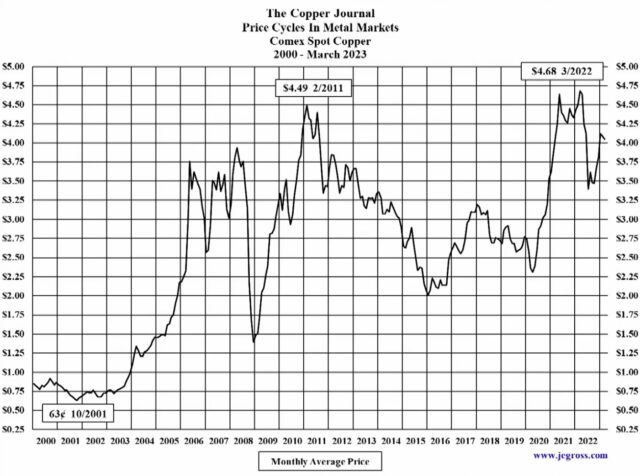

According to Gross, the price for copper, which is still relatively low, is expected to see record highs in the coming years. The projected increase is due to manufacturing reshoring in the U.S. – which is creating an increased need for refined and scrap material – the electrification of the country (e.g. EVs), and China’s stated plan to increase scrap imports.

Figure 2: © The Copper Journal

Currently, the United States has two primary smelters operating: Rio Tinto in Garfield, Utah, and Freeport McMoRan in Miami, Arizona. A third smelter, ASARCO, located in Amarillo, Texas and owned by Grupo Mexico, closed indefinitely in 2022.

Said Gross, “We have a major smelter not operating and increased global competition for copper scrap. Our copper needs to stay here in order to meet projected demand.”

Bedingfield echoed Gross’ comments. The U.S. copper scrap market is two million tons annually, and “we export half of it,” he said. “We have a projected shortfall of 10 million tons between now and 2035.”

He added that copper needs to be identified as a Critical Mineral because it’s a diminishing resource that’s needed for defense applications – as well as the current Federal and state mandates for electrification.

Processing lower grades of scrap copper

Schilberg discussed how technological innovations and investments are resulting in the more efficient processing of lower grades of copper, including flake. “Even auto shredders can recover low grade copper,” he said.

SDI La Farga Copperworks was mentioned several times by the panelists as a copper success story. A joint venture between Steel Dynamics Inc., Fort Wayne, IN and Barcelona, Spain-based La Farga Group, the copper producer incorporates a unique process for producing its high grade InfinityTM copper.

Using reclaimed copper to lower environmental impact, the company produces Cu-FRHC (fire-refined, high conductivity) copper products that are 99.9% pure and meet ASTM B-49 standards.

More copper has to be retrieved from the waste stream

According to Bedingfield, the auto shredding stream contains 200 tons of un-reclaimed copper scrap – mostly due to mixed material sorting challenges. “Scrap recyclers can improve sorting by upgrading facilities or machinery where possible,” he said.

Over 7 million tons of e-scrap (discarded electrical equipment containing copper and other metals) is being created each year, with 6 million tons being sent to landfills.

See our post about Apple’s Taz, a pilot-scale industrial shredder, designed to help conventional bulk electronics recyclers recover more precious rare earth metals.

Because more manufacturers want to meet their own sustainability standards, Bedingfield adds that copper recyclers will need to incorporate “green” processes into their recycling processes.

These processes include many of the types of projects which K2’s sister company, Abby Industrial, has implemented for larger recyclers, such as air scrubber systems and waste water treatment systems.

My take on extracting more copper from scrap: Larger shredding operations are finding copper recovery to be a vital key to maintaining profitability. In the last 15 years, the focus was on aluminum products (zorba). Aluminum content is high in the shredding stream and it was the largest dollar generator. Dry sorting eddy currents and induction sorters became mature extract solutions. Now the focus is on copper.

Coppers are the volume x value = $ item in the shredded metals stream. Insulated Copper Wire (ICW), previously a low value nuisance grade, is finding its way to shredder operated chopping lines. Operators are mining their fines for copper using methods involving wet, dry, or extra grinding to extract value that was considered too costly to harvest just a few years ago.

“Bullish” on the U.S. copper industry

All three panelists, citing the significant investments and advances being made in the industry, remain bullish on copper. Schilberg’s company, Prime Materials Recovery for example, operates two copper mills in North Carolina and has implemented a process not done in the U.S. in over 30 years.

Bedingfield’s company, Weiland N.A. Recycling, recently purchased Totall Metal Recycling in Granite City, Illinois. “Totall Metal is absolutely different from anything Wieland (a German-based company) has done,” he said. The recycler mechanically processes scrap to size, and then separates, cleans, screens, and packages it into supplementary raw material for smelting and refining.

The bottom line, however, is that the United States has to remain competitive. All three panelists agreed that copper – refined and scrap – has to remain here. And, Bedingfield added, “recyclers need to diversify their sales to domestic refiners and smelters versus exporting.”